what happens if my bank returned my tax refund

2 2My return got accepted. Answer 1 of 8.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

It will take a while hit the money will eventually be returned to the IRS.

. 3 3If Your Tax Return Is Accepted. I checked with my bank about my tax refund and it was returned to the IRS because I had given you the wrong account. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

If the third party bank is unable to deposit to the account provided they will either mail you a check or return the refund to the IRS. The IRS sends CP31 to inform you that your refund check was returned to the IRS. Call or visit your bank if you gave the IRS an account number containing inaccurate digits.

You may call us toll-free at 800-829-1040 M - F 7 am. If the return hasnt already posted to our system you can ask us to stop the direct deposit. If the direct deposit was directly from the IRS the bank would send it back to the IRS who would.

If you cant update your mailing address online. What happens if my tax refund is rejected. The IRS is requesting a new address to mail the check.

Meanwhile you should give them the correct information so that when the money does come back it can. 1 1Does accepted mean my refund is approved. Check For The Latest Updates And Resources Throughout The Tax Season.

When that bank refuses the direct deposit where it goes back to depends on where it was from. Giving the wrong account number may have caused the IRS to deposit your refund into the. It will be sent back to the Internal Revenue Service if it is refused because the account information does not correspond to the.

My bank gave me a trace that the IRS provided. Generally when someone enters the wrong bank account number on a tax return the refund isnt sent anywhere. This is because nobody is holding an account under that account number.

How To File Income Tax Returns Online Income Tax Return Tax Return Income Tax

Irs Adjusted Refund Letter What To Do When The Irs Changes Your Tax Return Check Amount

How To Track Your Tax Refund S Whereabouts Cbs News

How Can I Get Direct Deposit My Tax Refund Direct Deposited To My Green Dot Account Green Dot

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

How Long Does It Take To Get A Tax Refund Smartasset

12 Reasons Why Your Tax Refund Is Late Or Missing

Here S How Long It Will Take To Get Your Tax Refund In 2022 Cbs News

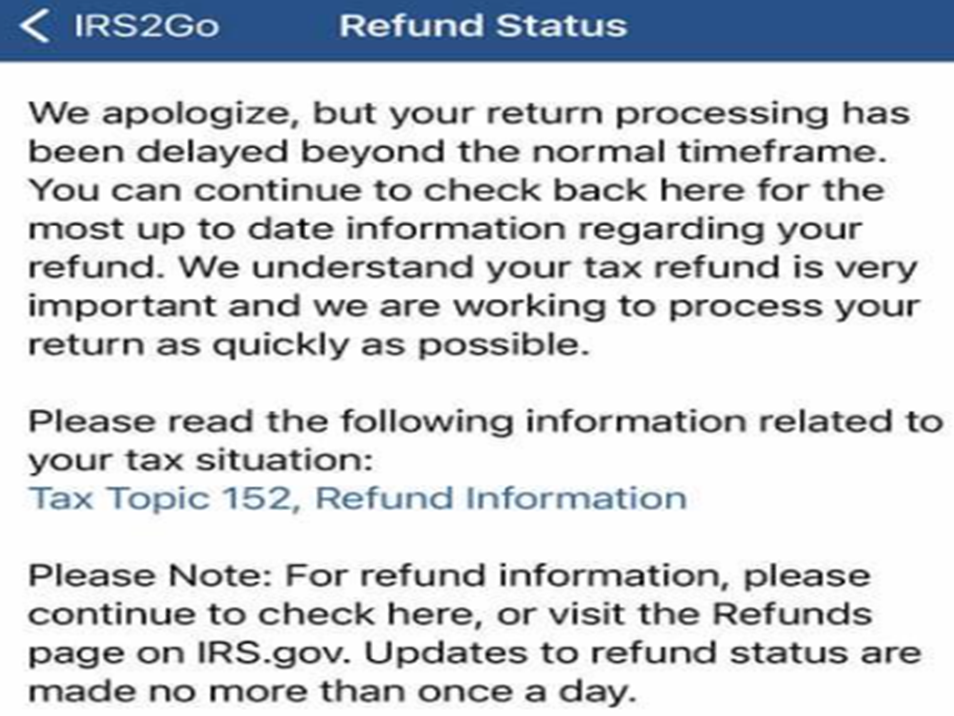

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

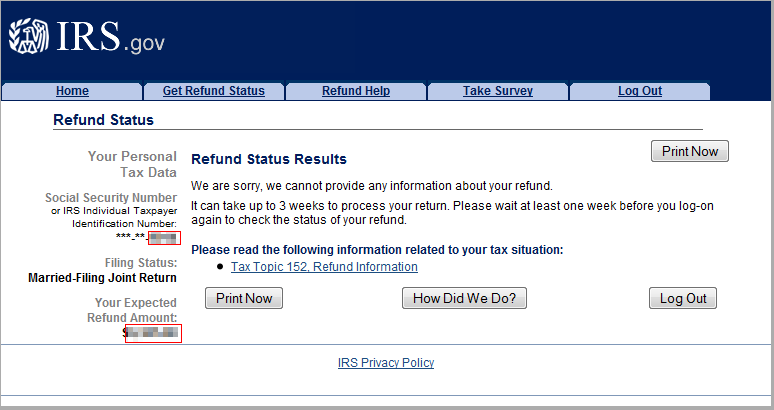

We Cannot Provide Any Information About Your Refund Where S My Refund Tax News Information

Tax Topic 152 Refund Information What Does Topic 152 Mean Marca

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

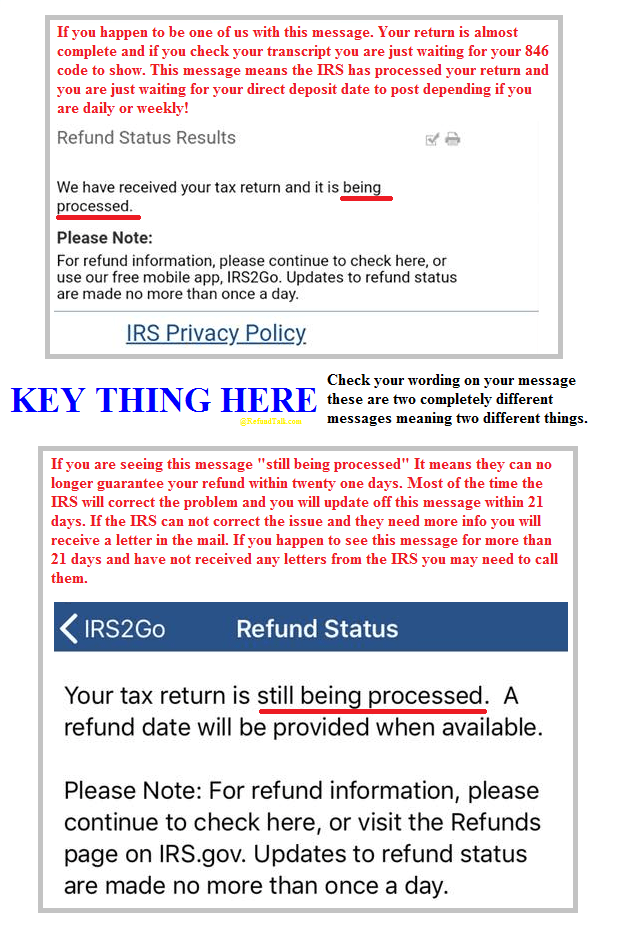

Irs Still Being Processed Vs Being Processed Where S My Refund Tax News Information

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

Free Download Bank Account Authorization Letter Lettering Letter Sample Consent Letter